Speculative Growth Is Heating Up

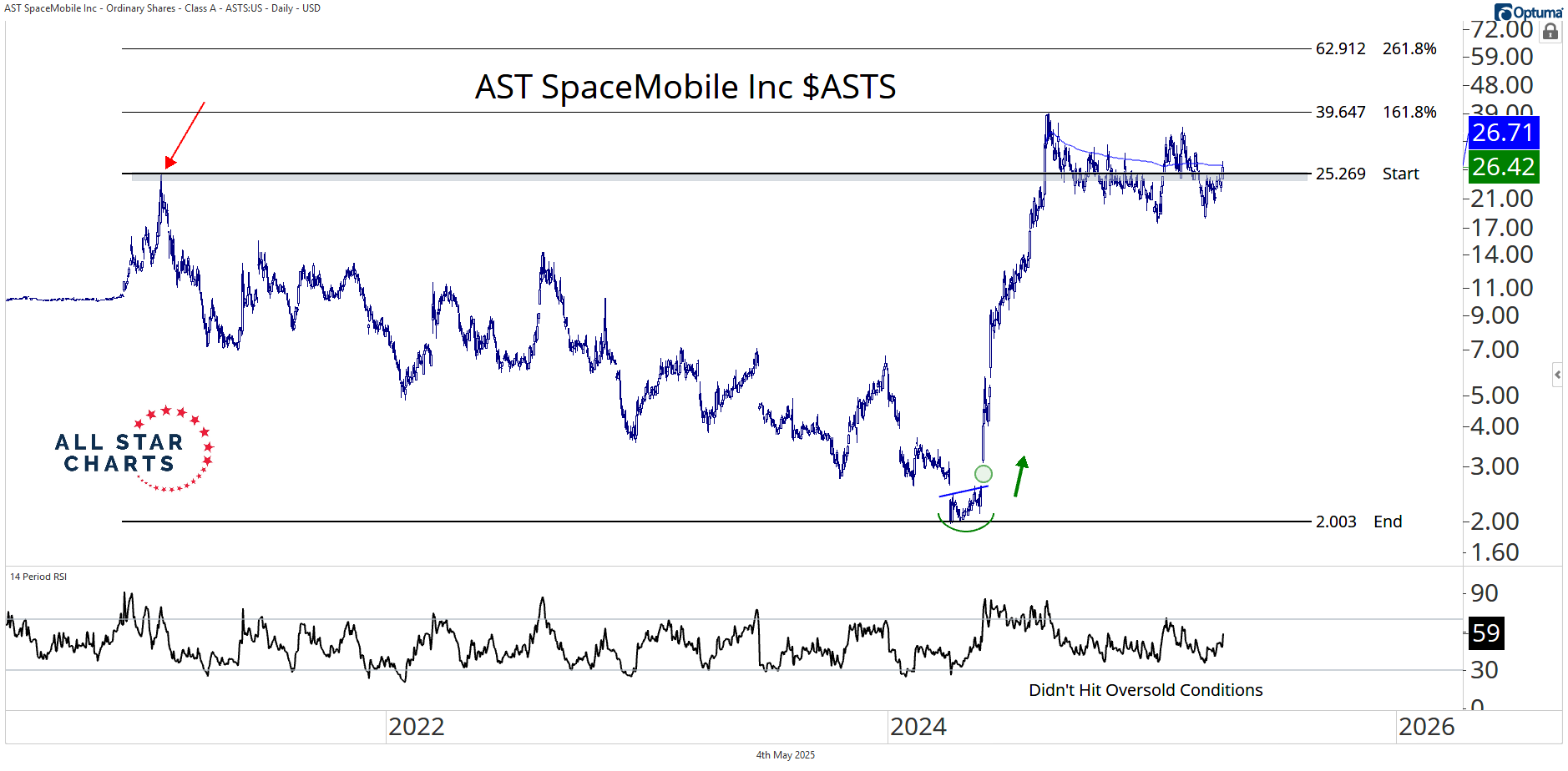

Next, we have AST SpaceMobile Inc $ASTS:

ASTS has spent the past six months moving sideways, digesting gains from last year’s vertical move.

Price is pressing against a confluence of resistance marked up with the 2021 peak and the anchored VWAP from the all-time high.

This area makes it a logical area to define risk and trade against.

Notice how the underlying trend has remained in a bullish regime throughout this entire base.

We’re buyers above 25.25 with an initial target of 39.50 and a secondary objective of 63.

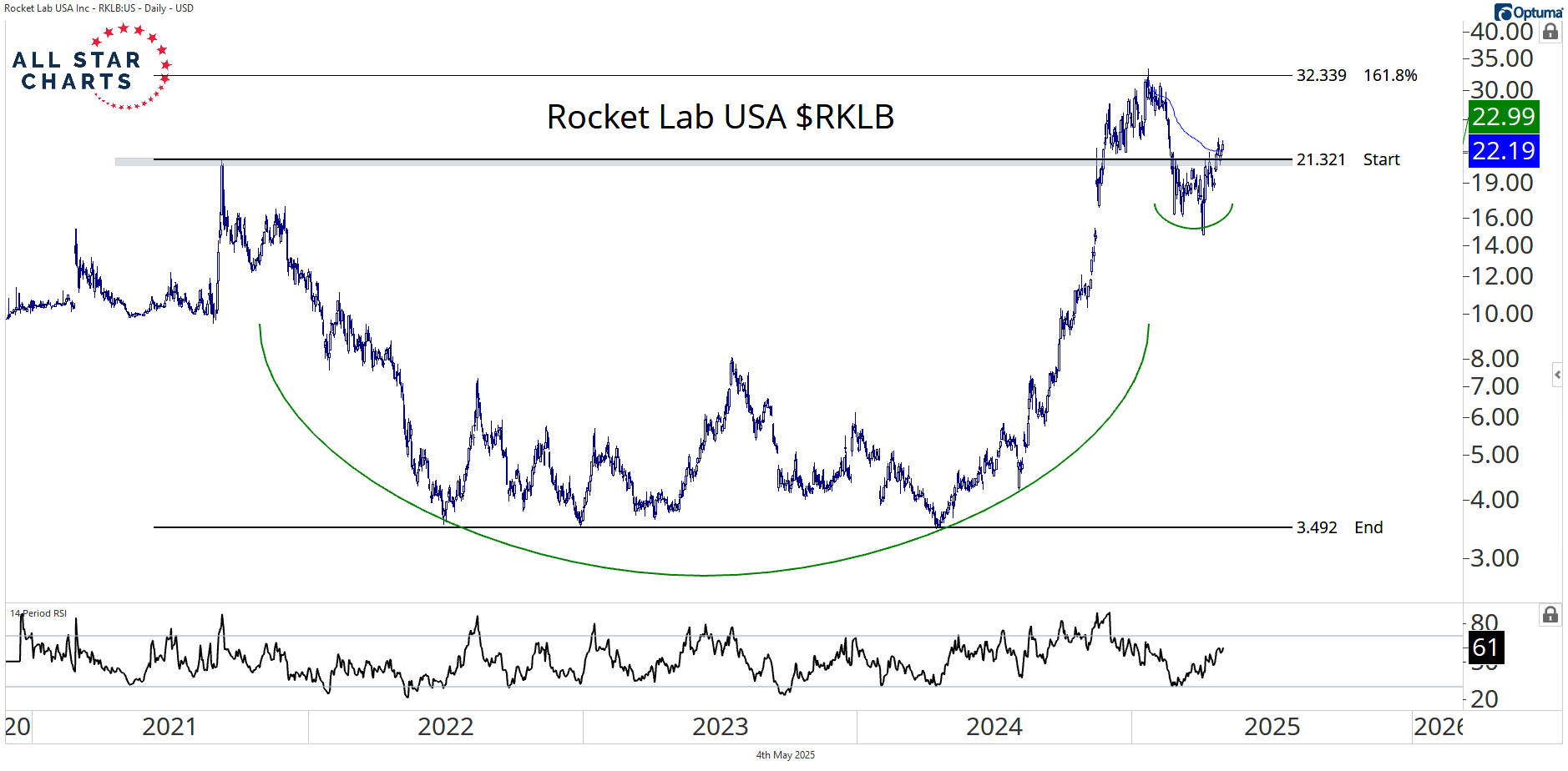

Then, we have Rocket Lab USA $RKLB:

RKLB is breaking out of a multi‑month base, reclaiming both the peak from 2021 and the the anchored VWAP from the all‑time high near 21.30.

This polarity zone is our line in the sand.

If we’re above 21, we want to be long, targeting 32.25 first and 50 on a secondary objective.

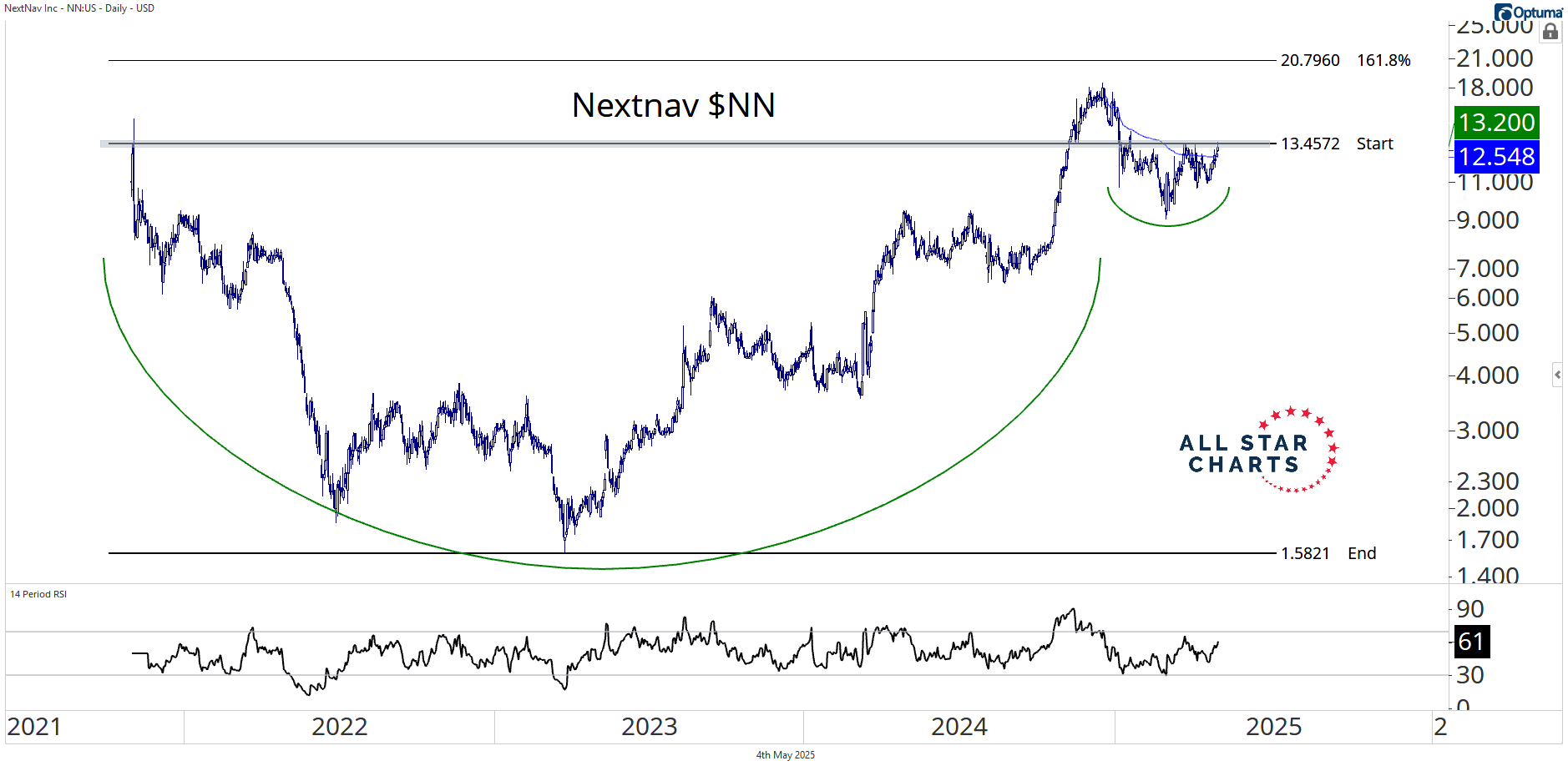

Our fourth setup today is Nextnav Inc $NN:

NN has been steadily climbing for two years, forming a classic series of higher highs and higher lows.

The price has been consolidating just beneath a key former high that coincides with the IPO level from 2021.

A breakout above 13.50, will confirm the next upward move.

We’re targeting 20 in the coming 2-4 months.

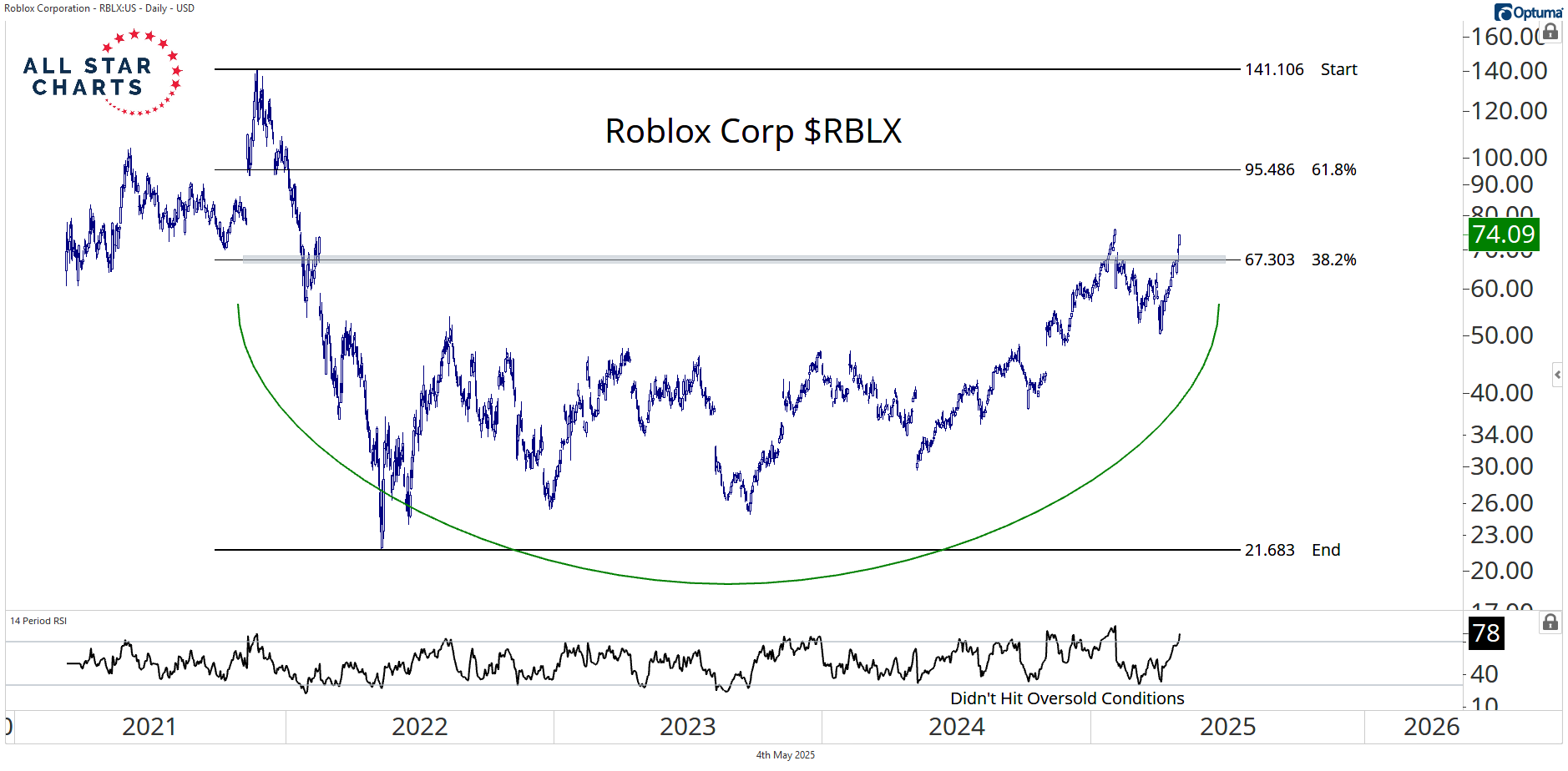

Last but not least, we have Roblox Corp $RBLX:

RBLX has spent three years carving out a textbook bearish-to-bullish reversal pattern.

The stock never hit oversold on the 14‑day RSI and now is accelerating higher, piercing through the 38.2% retracement level.

The risk/reward is skewing in favor of the bulls and we want to own RBLX above 67.30 with a target of 96.

We eventually think it will hit 141 over longer timeframes.

Alfonso