Feeling Positive Energy

First up is the multinational integrated oil & gas blue-chip, Chevron $CVX:

CVX just bounced off the VWAP from its 2020 low and the lower rail of its two-year range—this is a textbook confluence of support. We even have the prior-cycle highs from 2018 coming into play here.

To get one of the largest energy companies in the world at such a major polarity zone is a gift, in my opinion.

Relative strength versus XLE sits on a decade-long support zone, hinting at a turn.

We’re not trading a breakout here, just the range. As long as CVX is above 132, we’re long, targeting 186 back at the range highs. We can reassess once we’re there.

I really like the dividend here, too. It’s almost 5%. What a deal.

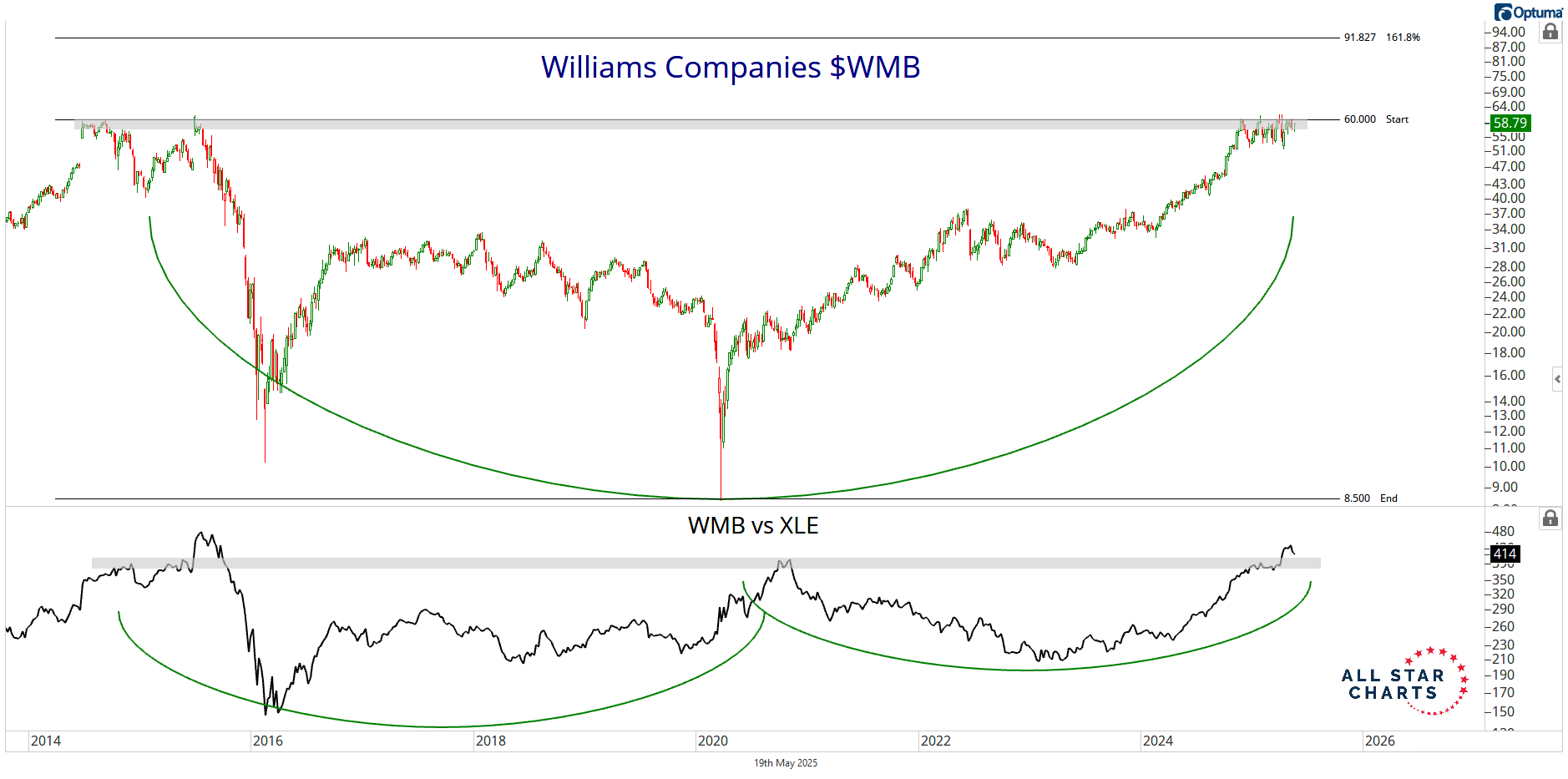

Next, we have an energy infrastructure leader, Williams Companies $WMB. This one pays a 3.40% yield:

WMB has carved out a massive decade-long base. For the past 6 months, the midstream giant has been coiling in a tight range below all-time highs, looking poised to explode out of this pattern.

On a relative basis, WMB is pressing against the lip of a decade-long cup-and-handle. We can use a breakout in the relative trend as confirmation.

A weekly close above 60 will be our trigger to enter, as it should set the stage for the next leg up.

We’re buyers of WMB on strength above 60 with a target of 92.

Now for a small-cap natural gas play. This is Comstock Resources $CRK:

CRK is resolving a monster decade-long base as it reclaims its all-time-high VWAP. This reversal is in the books, and the bulls are firmly back in control over longer timeframes.

As for the relative trend, CRK is completing a similar pattern and breaking out of an equally massive base compared to its energy sector peers.

This stock is levered to the price of natural gas, so it tends to run fast once it gets going.

As long as CRK remains above 19, we want to be buyers targeting 64.

Our fourth setup today is Kodiak Gas Services $KGS:

Since its IPO around two years ago, KGS has done nothing but create shareholder value. The strength and leadership in KGS show no signs of waning. After a shakeout below the 38.2% fib from its entire run, the stock is looking to scoop higher.

On a relative basis, KGS has strung together nothing but higher highs and higher lows versus XLE.

Our trigger level is 37, which also represents the VWAP anchored to the all-time highs. A close above will signal that buyers are back in control, and the path of least resistance is higher.

We’re long KGS above 37 with a target of 51.

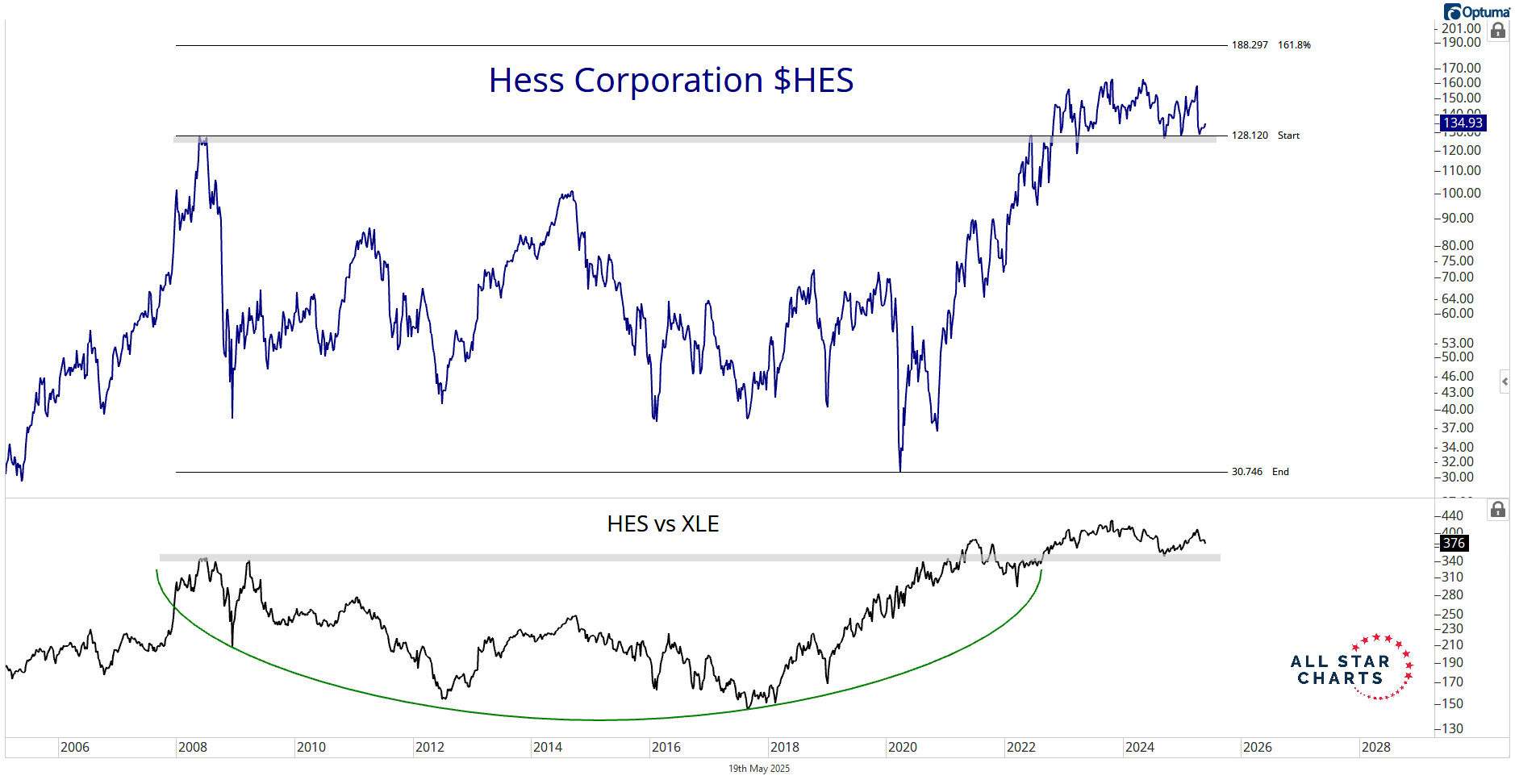

Our next setup is the large-cap exploration & production company, Hess Corporation $HES:

HES spent the past two and a half years trading in a tight range after breaking out of a massive financial crisis base. Time after time, bears have failed to break it back into its old range. I think there’s only one direction left for HES to go, and that’s up.

On a relative basis, HES is in a similar position vs the broader energy sector. This multi-decade base appears to have completed, suggesting more leadership to come over the long run.

If we’re above 128, we’re long HES, targeting 188.

Next we have the oil & gas royalty company, Landbridge $LB:

LB just resolved a textbook continuation pattern and is poised to continue its advance. The breakout above the multi-month ceiling around 79 is our signal that bulls have resumed their unrelenting bid.

On a relative basis, LB has been printing nothing but higher highs and higher lows vs the broader energy space. We want to make the bet that this leadership continues.

If we’re above 79, we want to own LB, with a measured move target of 105.

Last but not least, here’s exploration company Gulfport Energy $GPOR, which has exposure to both natural gas and crude oil:

Gulfport Energy has been stair-stepping higher after breaking out of its post-IPO base two years ago. We're looking to get long as it attempts to break out of a multi-month tactical base near all-time highs.

On a relative basis, it's already printing fresh all-time highs vs the energy sector, a sign of strength and leadership that hints at a breakout on absolute terms.

Above 185, and we’re buyers of GPOR with a target of 262.

That’s it. This is our playbook to profit from a rebound in energy.

If these trades start working and energy does what we think it’s going to do, we’ll have more long ideas soon.

Steve