Silence is the Sound of Opportunity

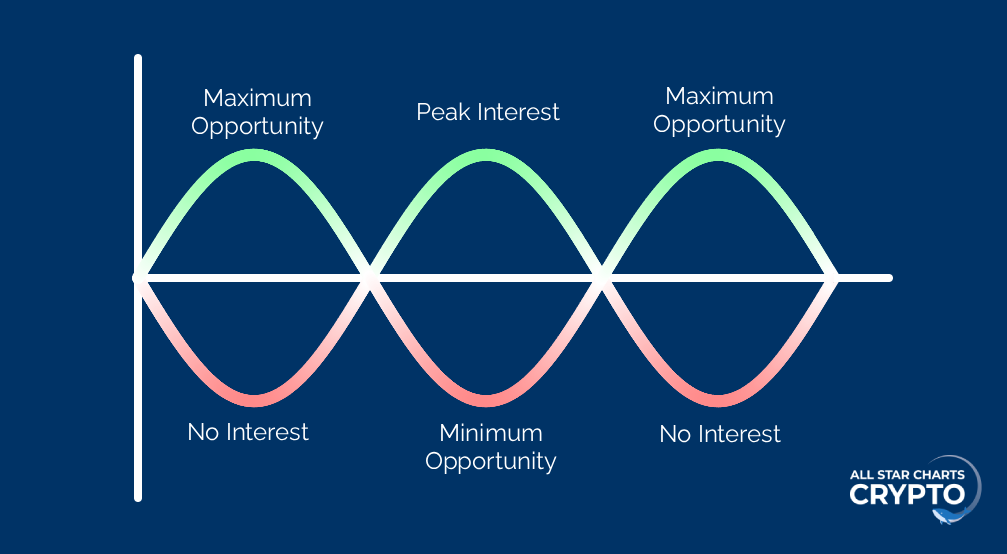

When the crowd loses interest, that’s when opportunity starts to build.

Over the past few weeks, the entire altcoin market collapsed. Prices cratered, leverage evaporated, and traders were forced to exit positions they should never have held in the first place. The casino kicked them out, and suddenly everyone stopped talking about crypto again.

Now the charts look chaotic. Sentiment is exhausted. The same people who were euphoric months ago are convinced the party’s over.

This is exactly how every strong uptrend resets itself. It takes time for the dust to settle. While that happens, the rubber band quietly stretches in the opposite direction.

Silence is the sound of opportunity

The bull market didn’t die. It just shed the excess.

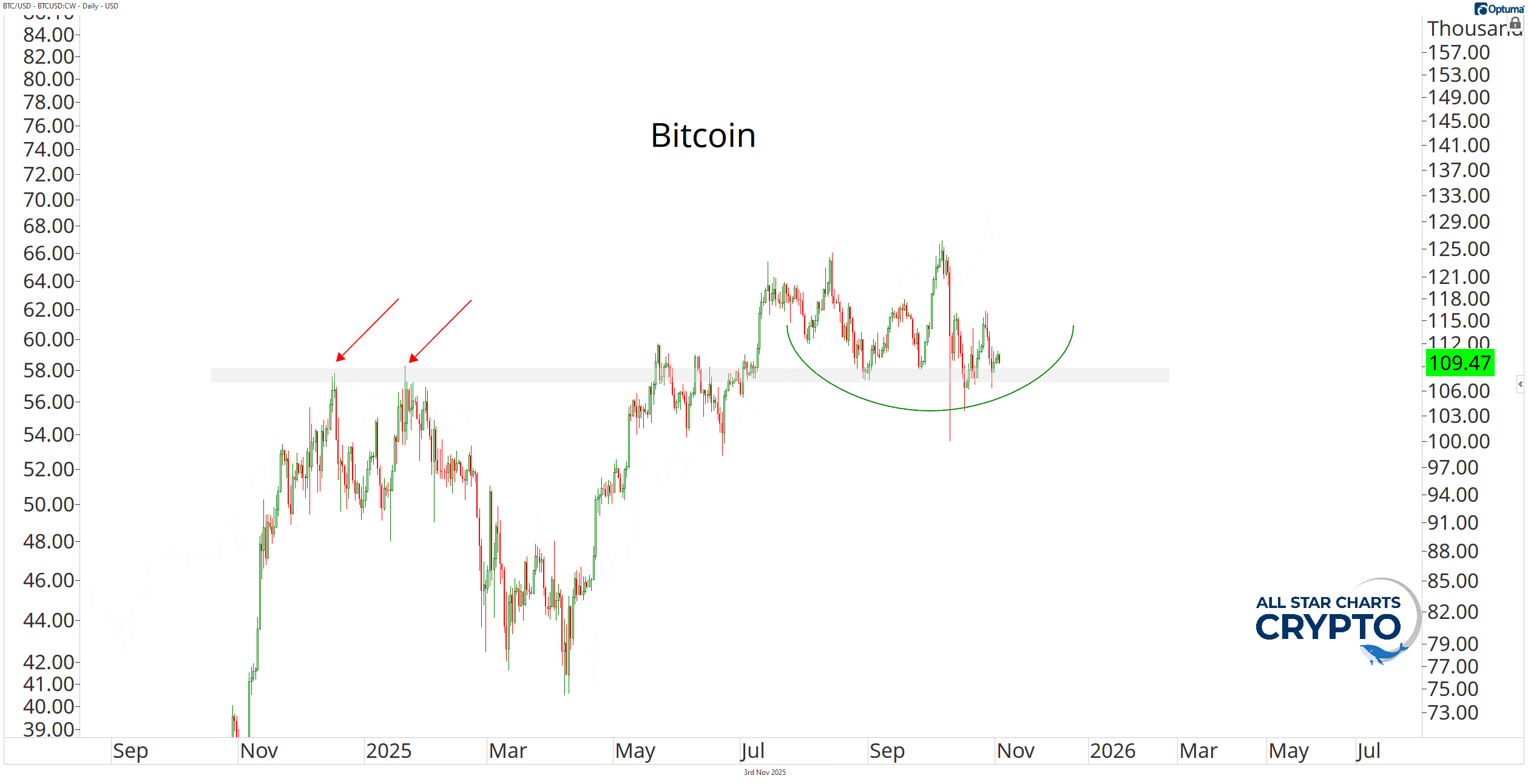

Bitcoin is still holding its breakout in six figures.

The flush cleaned out bad leverage and low-quality projects that had no adoption or narrative support.

The serious ones keep building.

My bet is Bitcoin sticks the landing here.

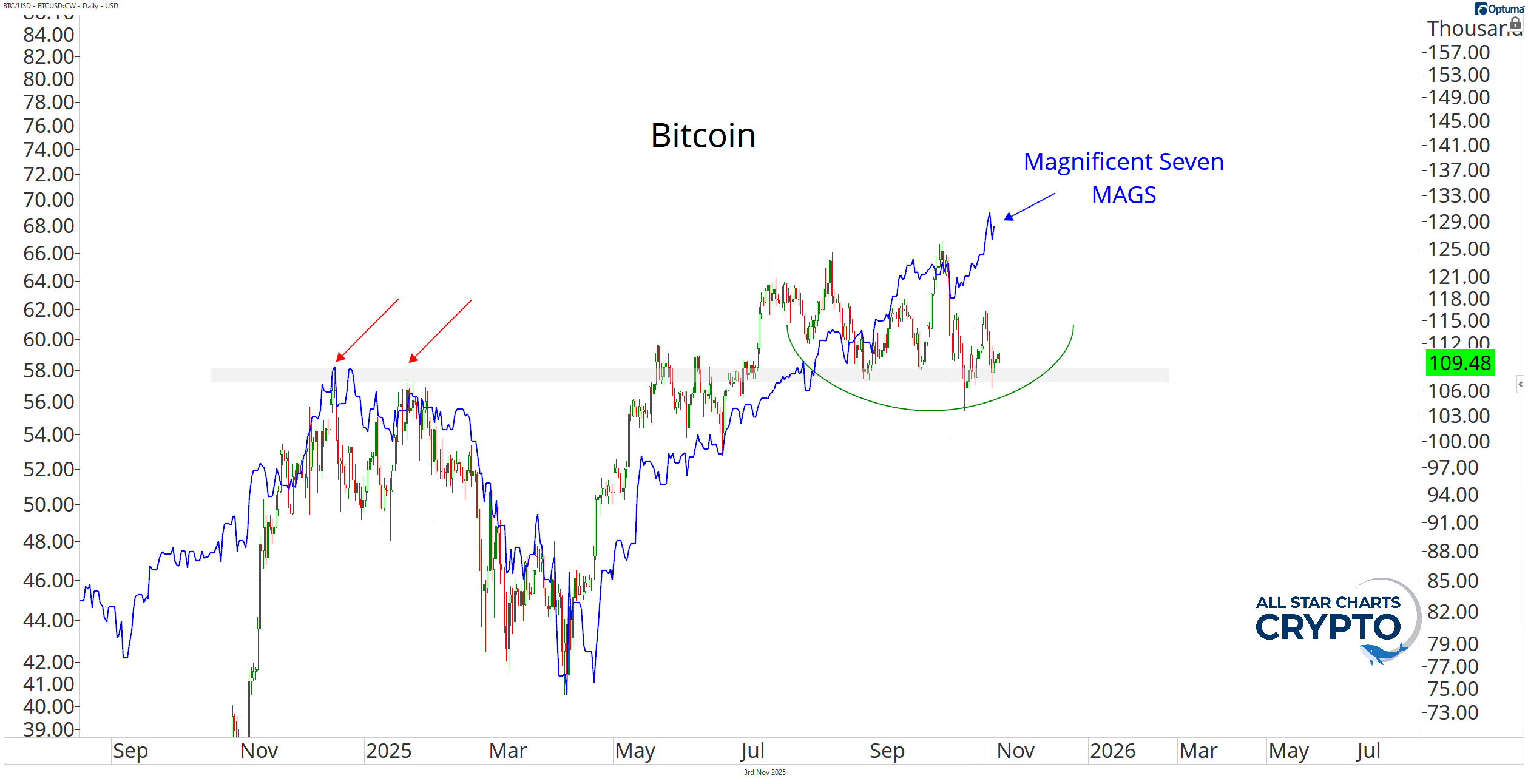

I think of Bitcoin the same way I think of the Magnificent Seven, it trades like a mega-cap growth stock. And while the Magnificent Seven are printing new all-time highs on strong earnings, Bitcoin’s lagging.

That lag is creating an opportunity.

When risk assets are making highs and Bitcoin’s consolidating, it tells you where the next rotation can come from. The rubber band’s stretched, sentiment’s flat, and no one wants exposure; that’s how every catch-up trade begins.

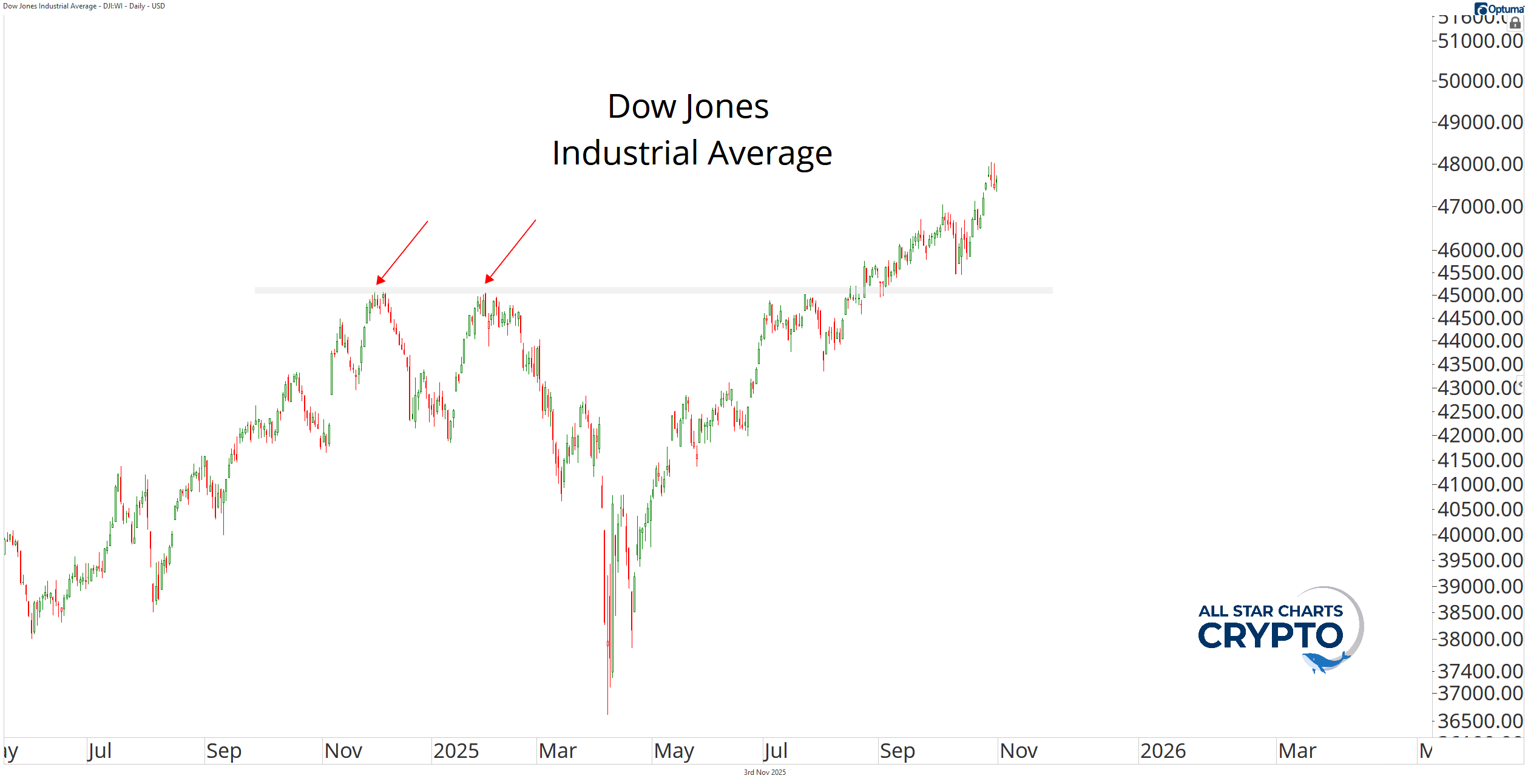

The Dow is breaking out. The S&P is breaking out. The NASDAQ is pushing into blue sky territory.

Apathy now means positioning is light.

When conditions stabilize, capital looks for what hasn’t yet moved.

That’s where crypto comes back into play.

From where the sun rises first,

Louis Sykes

Senior Crypto Analyst, All Star Charts