The Perpification of Everything

Whether you like it or not, 24/7 trading in the stock market is coming.

It’s going to be dreadful for your mental health, but at least it’ll make the asset managers more money.

But the question is how?

Because the stock exchanges only operate on a fixed schedule, so are they going to keep the lights on overnight and during weekends?

Probably not.

Here’s how it’s already playing out, in real time.

Back in 2017, BitMEX (an early crypto exchange) launched perpetual futures. These are futures contracts that never expire and are always tradable.

Reckless crypto traders loved it, because it meant they could trade with leverage any time or any day.

But large financial institutions caught onto something.

They don’t need to re-engineer the traditional financial system, they can build around it.

Using crypto’s famous perpetual futures, they can create a way to trade traditional assets using crypto’s 24/7 calendar.

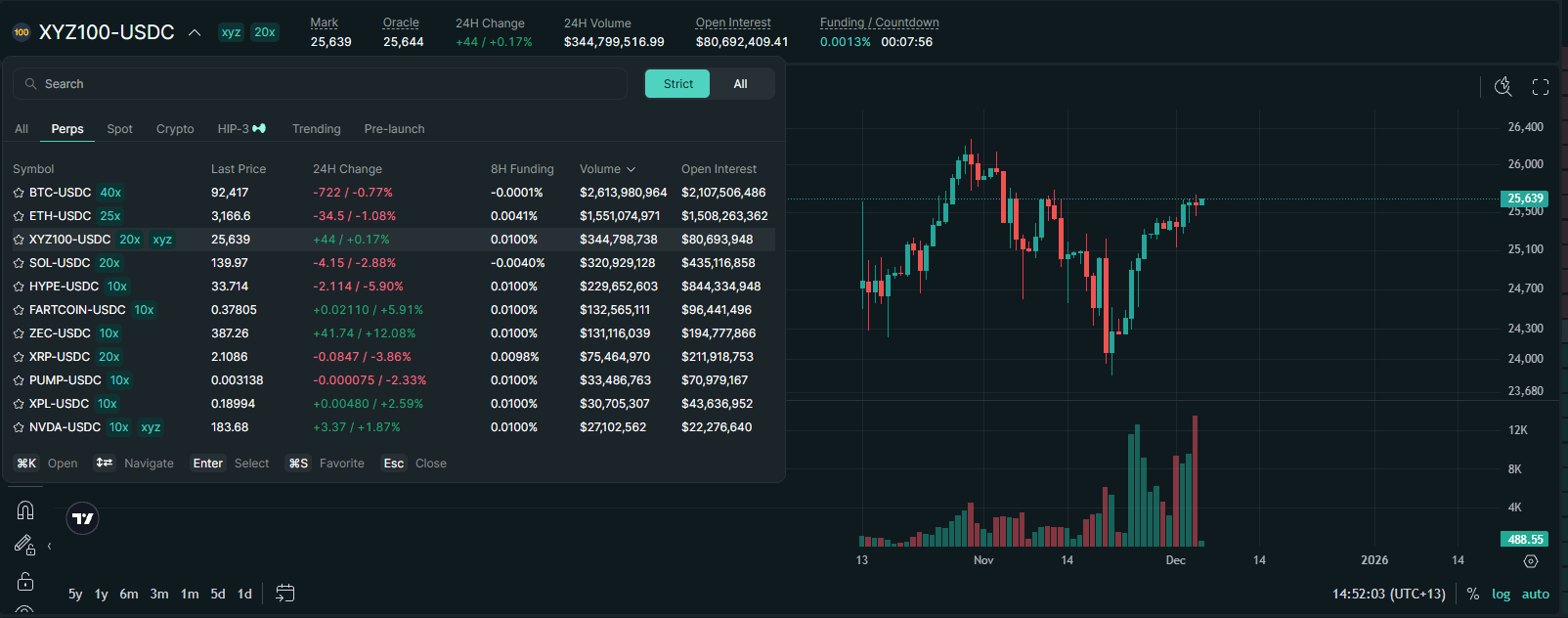

For example, on Hyperliquid, the largest decentralised derivatives exchange, users can trade a perpetual futures contract of the Nasdaq 100 or Nvidia right next to perpetual futures of Fartcoin.

What a world we live in.

And while it’s still in its infancy stages, it’s one of the clearest signals yet of where markets are heading.

This is the bridge.

Crypto built it for its own reasons: leverage, speculation, freedom from market hours. But Wall Street is already walking across it.

Liquidity doesn’t sleep.

And pretty soon, your portfolio won’t sleep either.

This shift won’t happen all at once. First it’s niche platforms like Hyperliquid offering 24/7 synthetic access to equities and indices. Then liquidity deepens. Then institutions start hedging there. Then retail brokers quietly plug into the same rails. And before anyone formally changes exchange hours, the effective market for everything, stocks, commodities, indices, is already trading around the clock.

It’s the same playbook crypto has run for a decade: build the strange thing on the fringe, let degens battle-test it, then watch traditional finance borrow the blueprint once it’s safe, cheap, and profitable.

So when does 24/7 trading actually “arrive”?

When no one notices it did.

One day you’ll wake up on a Saturday morning, check your brokerage app, and see that Nvidia is up 2.3% overnight because Asia pushed the perp markets higher. You won’t be trading US equities, you’ll be trading their synthetic shadows.

And the synthetic shadows will increasingly set the price.

At that point, exchanges won’t need to extend their hours. They’ll simply follow the market that’s already moving without them.

Traditional finance has spent decades trying to make markets more efficient. Crypto accidentally built the most efficient mechanism of all: a market that never closes.

Whether that’s good or bad for your sleep schedule is another story.

But make no mistake, 24/7 markets aren’t a prediction anymore.

They’re coming.

And soon, they’ll be impossible to ignore.

From where the sun rises first,

Louis Sykes

Senior Crypto Analyst, All Star Charts