Crypto's Great Divide

The great divide is the easiest opportunity I've ever seen to make money in crypto.

You simply own the cryptocurrencies that capture value, and ignore the ones that don't.

Let me explain.

Investors are fed up with worthless assets that don’t do anything. Crypto is littered with them; tokens that serve no real purpose and offer no rights to their holders.

Think about it this way.

When you buy a stock, there is a direct economic link between how well the company performs and your wealth. You have a legal ownership stake, and you’re typically rewarded through dividends, buybacks, earnings growth, or multiple expansion.

Most cryptocurrencies don’t work like this.

More users on a blockchain does not automatically mean the token holder benefits. Adoption and investor outcomes are often completely disconnected.

That’s why the great divide is already forming.

A divide between cryptocurrencies that actively reward investors and those that don’t care at all.

I’ve done the work, and the reality is stark: 99% of crypto assets fall into the latter category.

Do you know which cryptocurrencies made investors the most money last year?

The ones with buyback mechanisms; structures that directly returned value to holders by reducing supply and pushing prices higher.

A chart from Fidelity shows that since January 2024, cryptocurrencies with buyback programs generated roughly $14 billion, most of which was distributed back to investors.

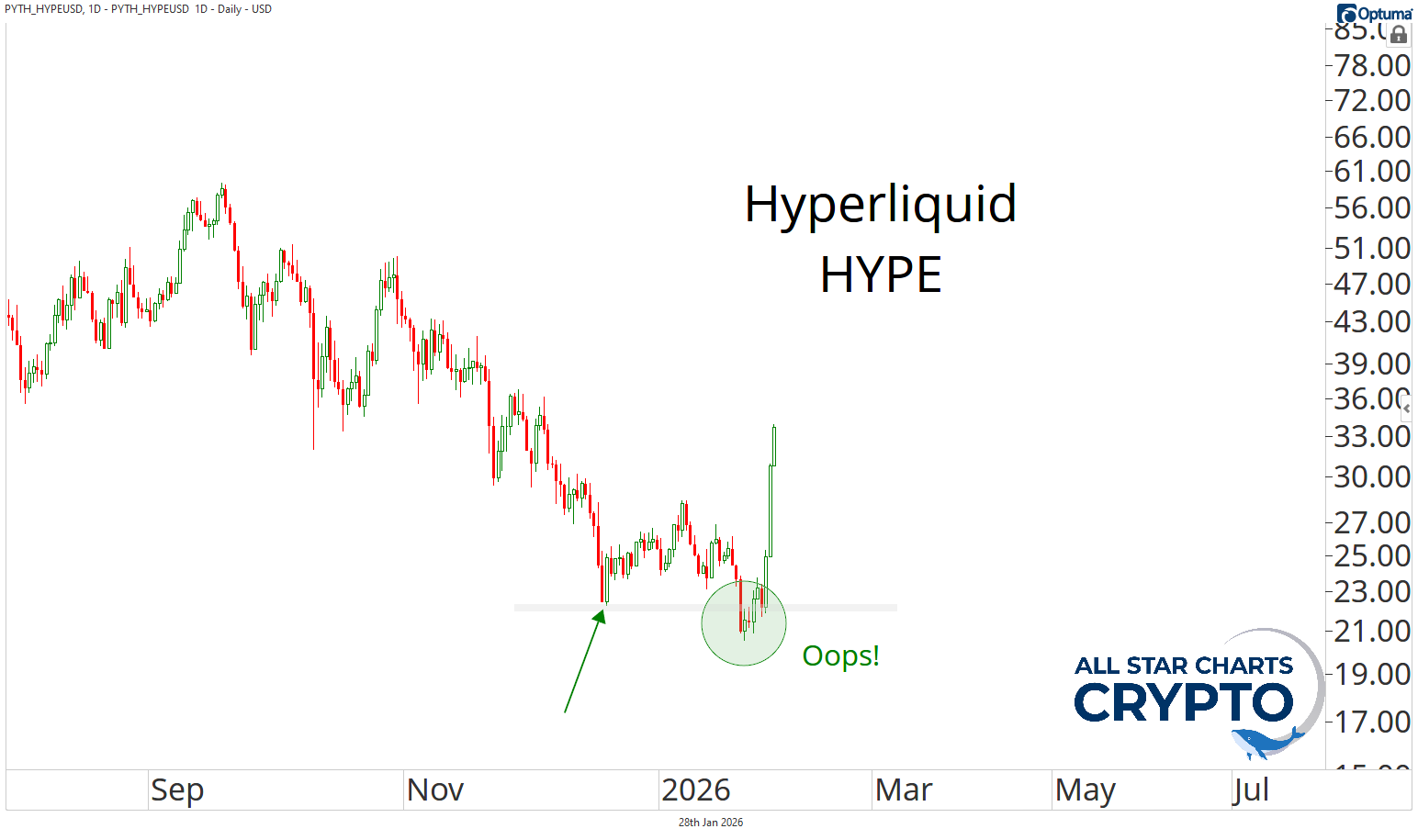

The clearest example is Hyperliquid $HYPE.

It’s generating over $1 billion per year and returning roughly 90% of that revenue to HYPE holders. Not surprisingly, it held up best during the recent crypto correction, and more recently, it’s gone vertical.

I think this gets back to all time highs in no time.

As the crypto market begins to recover, you need to ask yourself a simple question:

Are you holding assets that are designed to make their investors rich or ones that don’t care whether you make a dollar?

The great divide is only just becoming visible.

By the end of the year, it will be impossible to ignore.

You need to understand the mechanics of these cryptocurrencies if you want to make money in this sector.

And the same is true for the stock market. After three years of work, we're unveiling our new strategy that turns company earning reports into killer trades.

Our Chief Market Strategist, Steve Strazza, is going live Thursday at 2 p.m. ET to drop his three years worth of research.

You can't miss this.

Sign up to the event by clicking here.

From where the sun rises first,

Louis Sykes

Senior Crypto Analyst, All Star Charts