The Problem With Trump's Bank: World Liberty Financial

This isn't a political post.

I'm not even from the States, so I don't care about Democrats, Republicans, or whatever else.

I'm just here to make money, and one of the best ways to do that is by protecting my money. Not making bad investment decisions.

Crypto offers extraordinary opportunity, but only if you know how to navigate the market. There are traps everywhere.

Trump's DeFi project, World Liberty Financial, is one of them.

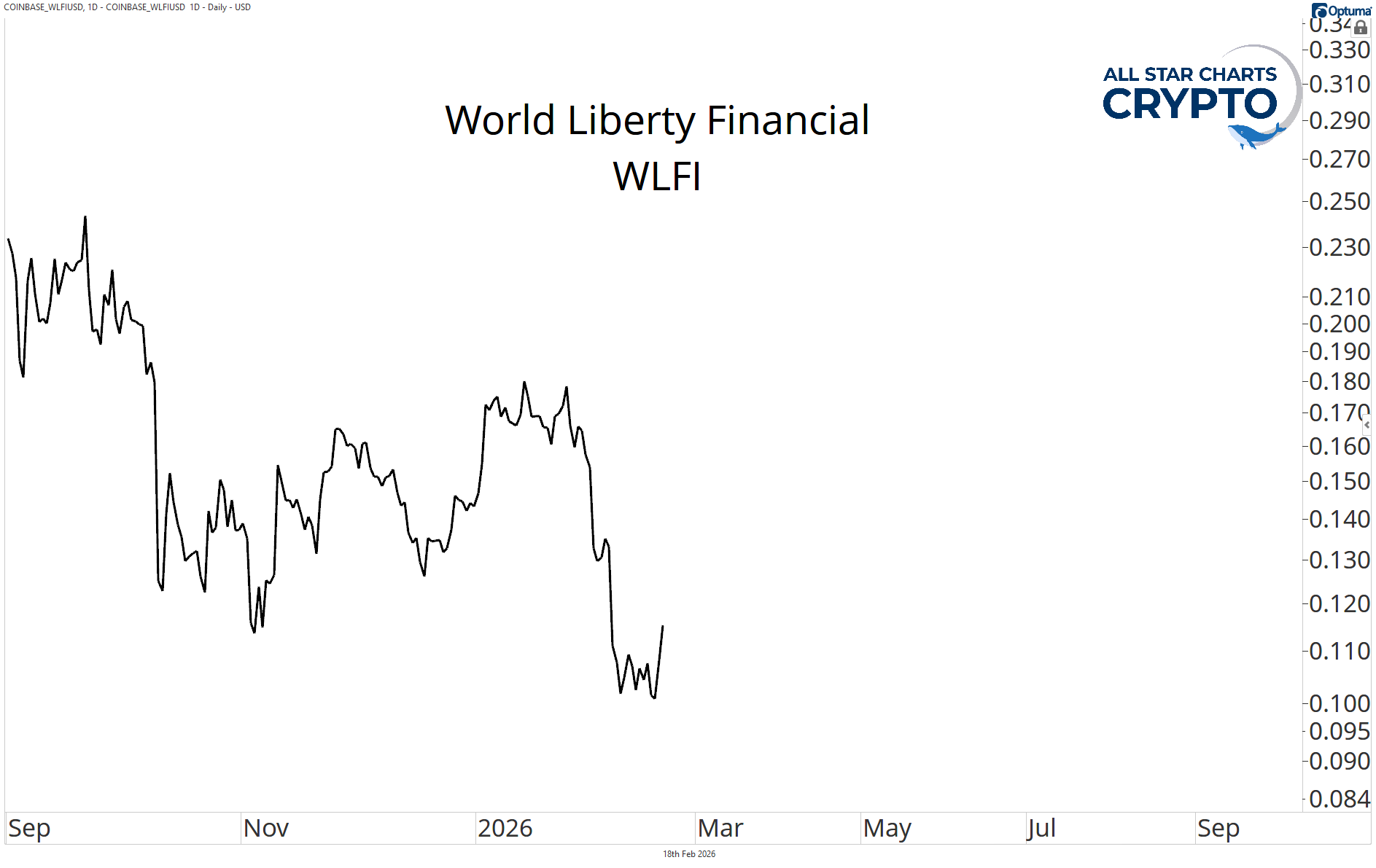

Since it started trading, this thing has lost more than two-thirds of its value.

People bought WLFI thinking that Trump's name being all over it must be a positive tailwind.

But the real problem is that this token doesn't even have a reason to exist.

When you buy WLFI, you don't ride any of the upside of World Liberty Financial. You don't own a share of its assets, you don't receive a cut of its revenue, and you don't get any dividends. In fact, 75% of net protocol revenue flows straight to DT Marks DEFI LLC, a Trump family entity.

The only purpose of this token is that holders get to vote on governance proposals. That's it.

In other words, imagine I was selling you shares of Coca-Cola. But when you bought those shares, I was the one pocketing the capital gains. I was the one collecting the dividends. All you got in return was the right to rock up to the annual shareholder meeting and cast a vote.

How much would you pay for those shares? Unsurprisingly, very little because they don't have any real value beyond a small amount of influence over the company.

That's the issue with World Liberty Financial.

Even if it becomes a runaway success, you don't participate in that success.

So I'm not invested, nor do I have any intention to be.

It's one of those 99% of cryptocurrencies that I avoid.

Cheers,

Louis Sykes

Senior Crypto Analyst, All Star Charts