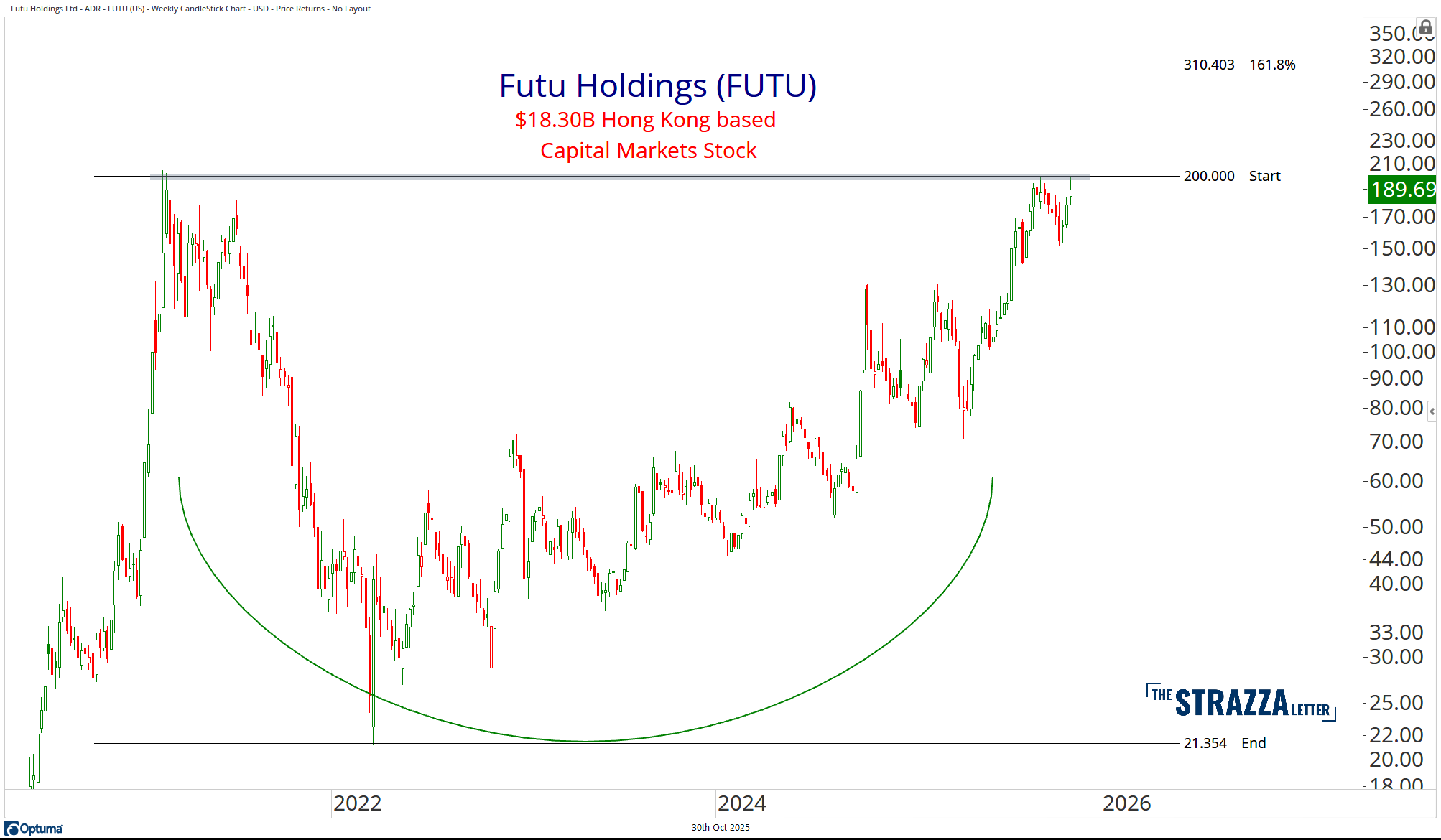

Steve Strazza breaks down sector rotation and market leadership trends everyday.

See Where Strength Is Building

The Strazza Letter dives into leadership, rotation, and momentum — revealing where market strength is building before it shows up on TV.