In March of 1997 Amazon filed an S-1 in anticipation of the company's IPO later that year. It was only 2 years after the Netscape IPO kicked off the first Internet stock bubble and party was just getting started. Though the "Internet" as a thing has in fact changed the world even beyond what could reasonably be expected at the time suffice it to say most of the companies coming public didn't live long enough to realize the dream (pour one out for Webvan.com).

What made Amazon's IPO stand out was the company's commitment to not making money. Possibly ever. The S-1 is a masterpiece of underpromise almost as impressive as the ensuing 30 years of execution.

With a grand total of $32 million in sales (on which it lost $9 million) Amazon announced its intention to "build strong brand recognition, customer loyalty and supplier relationships, while creating an economic model that is superior to that of the traditional book retailing business". In pursuit of this goal Amazon planned to spend money at such a rate that it all but guaranteed operating losses "for the foreseeable future".

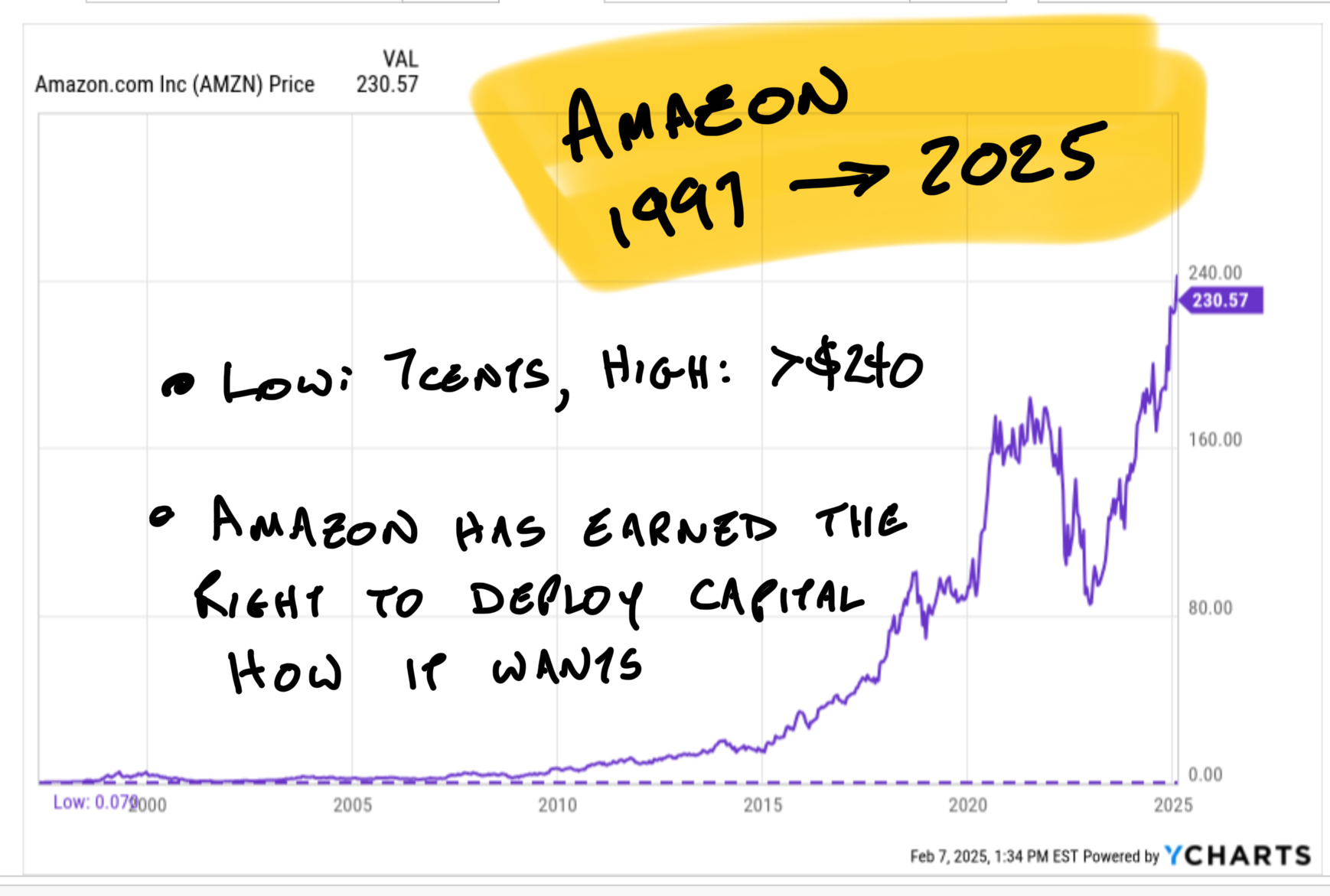

Last night Amazon reported net income of $20 billion, an amount equal to about 75% of the annual revenue of the US book industry. It's been a bumpy ride (Amazon lost nearly 95% of its value in the dot.com crash) but since 1997 AMZN has gone from 7 cents to the current $229. For those of you sweating the current 5% pullback here's a chart of Amazon declines since the IPO:

The Creator and Destroyer of Worlds

The S-1 is something of a business school masterpiece. From Amazon's vow to "create a strong brand" and take advantage of online efficiencies the company built what will be the biggest retailer in the world, by revenue and profits. And the kicker is Amazon is barely a retailer at this point. The company makes far more money on AWS than retail. Much was made over Amazon killing traditional book stores but Amazon could be chopped into 3 or 4 different companies, each of which "redefined" if not outright killed entire sectors.

Amazon's real secret was recognizing opportunities then throwing money and talent at it until a business was created (and, equally important knowing when to cut losses). Nothing illustrates the point better than Prime.

Launched in 2005 Prime was originally $79/yr in return for two day delivery on many (not all) items. That was it. Prime was barely even a product. At a less ambitious company that's where Prime would have stopped; as a way to limit delivery expenses and give Amazon an edge over other bookstores. It turned out a little different.

In 2006 Prime spun off Fulfilled by Amazon which allowed sellers to ship through Amazon for a fee. That business was the start of Amazon Third Party Services, which is now a $156b business fueled by Amazon's shipping capacity, funded by Prime. $156b is the equivalent of 1.5 Target chains.

And there's more. Because Amazon kept investing in efficient shipping the company built out a network of distribution centers, planes, trucks and everything else that goes with it. That turned out to be horrible long-term news for first the USPS which gradually lost the volumes created from Internet retail (~18% of all retail). UPS and FedEx are slowly suffering the same fate.

In 2011 Amazon sweetened the Prime offering by launching Prime video which, true to form, started as a joke and is slowly redefining how Americans spend our time. No one needed Thursday Night Football. Amazon just decided they wanted it and made it happen and a new habit was born (mostly bitching about the quality of TNF but it'll get better).

Today Prime has 200 million members in 25 countries. Subscription Services (of which Prime is part) is an insanely profitable $44 billion business, still growing 10% per year.

GOAT Capital Deployment Record

So today Amazon is down $9 because the company issued tepid growth guidance and huge investments. That's wrong. When a company spends 3 decades establishing itself as arguably the greatest deployers of capital in the history of American business in terms of creating cash-generating dreadnought divisions then announces that it's found a new world to conquer it's good news. I'd be honestly be more worried if the company said it was going to start issuing a dividend.

I already own shares and, as mentioned, 5% isn't much of a dip for these guys. If you aren't long you should be and this is as good a time to start as any.