Circle Just Proved My Crypto Thesis

My core thesis on crypto investing is simple: 99% of cryptocurrencies are worthless. The remaining 1% are redefining technology and finance.

That’s not a flaw of crypto - it’s the point.

Crypto is one giant experiment. Thousands of teams are pushing the frontier, and most of those experiments will fail. For investors, that means the vast majority of tokens eventually trend toward zero.

But the ones that work don’t just succeed, they create generational wealth.

This week, Circle proved this dynamic perfectly.

They signed an agreement to acquire the team behind a crypto project called Axelar $AXL. Buried in the fine print was the most important line of the entire announcement:

“This transaction solely concerns the Interop Labs team and their proprietary intellectual property.”

Translated into plain English: Circle bought the people and the technology - not the token.

If you believed in Axelar’s tech and team and expressed that view by buying AXL, you got nothing from this deal. Worse, the entire brain behind the project has now walked out the door to Circle.

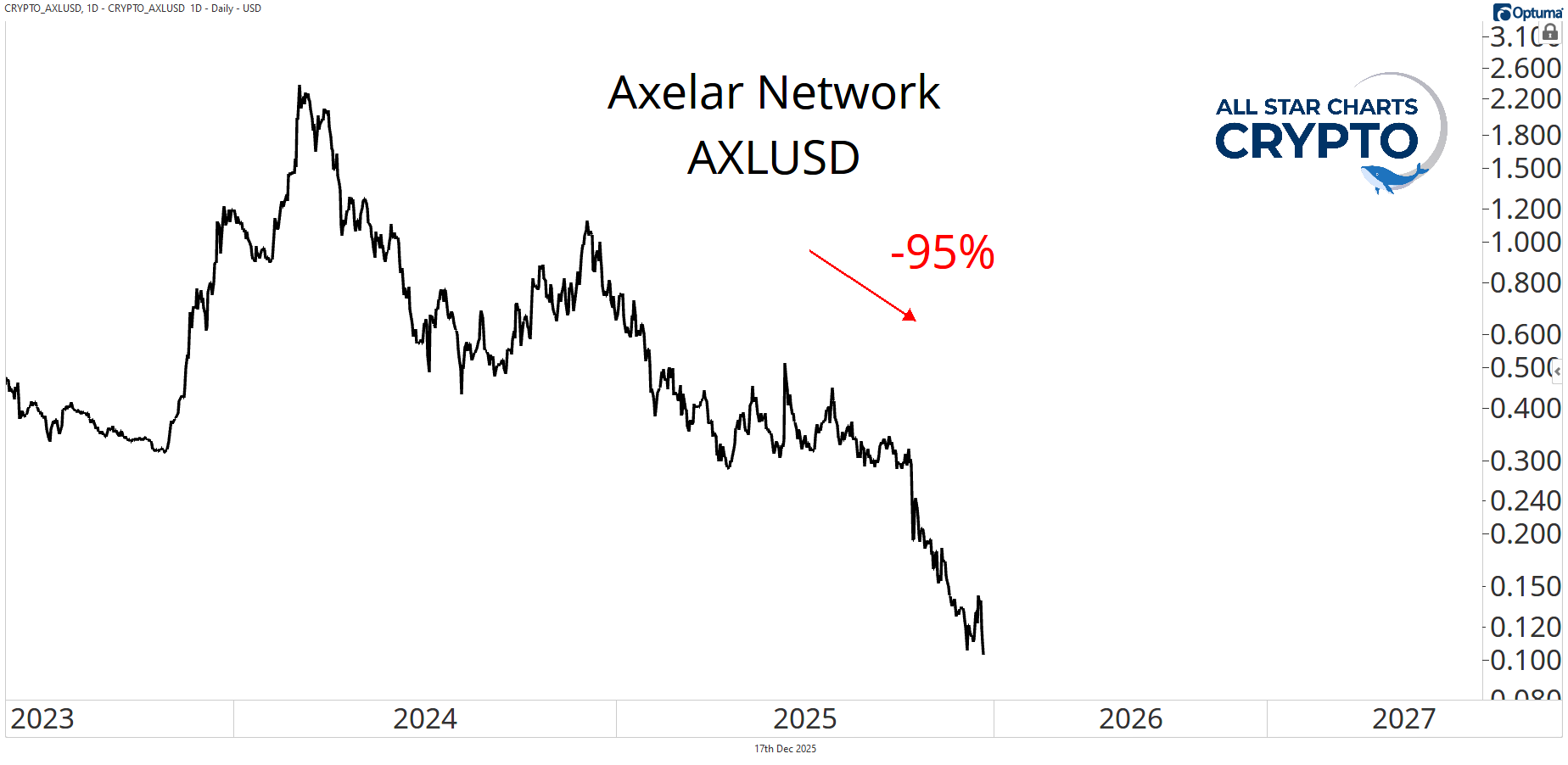

The token is already down ~95% from its peak. With the builders gone, it's going to bleed to zero.

This is why the popular take that “crypto is broken because tokens don’t capture value” is incomplete.

Some networks do reward investors as adoption grows. But more importantly, crypto tokens are not equity. Token holders don’t have legal claims on companies, IP, or cash flows the way shareholders do.

Instead, cryptocurrencies behave like deep out-of-the-money call options on new technology.

Most expire worthless. A few pay off spectacularly.

That’s the trade-off.

The base case in crypto investing is losing money. The upside case, if you’re right once or twice, is life-changing returns as compensation for taking that risk.

My claim that 99% of tokens are worthless? Circle agrees. That’s exactly why they won big by acquiring Axelar’s team without touching its token.

The implication is obvious: Crypto investing is not about owning technology, it’s about correctly identifying which experiments will survive and which tokens are structurally positioned to benefit if they do.

Get that wrong, and you own a souvenir.

Get it right, and you own an option on the future.

From where the sun rises first,

Louis Sykes

Senior Crypto Analyst, All Star Charts